top of page

Financial Resources for Businesses

Accrual vs. Cash Accounting: What You Need to Know to Choose the Right Method

Choosing the right accounting method is one of the most important decisions small- and mid-size business owners make—one that impacts financial clarity, tax planning, and day-to-day management. Two primary methods exist: cash accounting and accrual accounting. Each offers distinct advantages, and understanding how they work will help you select the approach that best supports your operations and long-term goals.

Cherie Sayban

Dec 8, 20253 min read

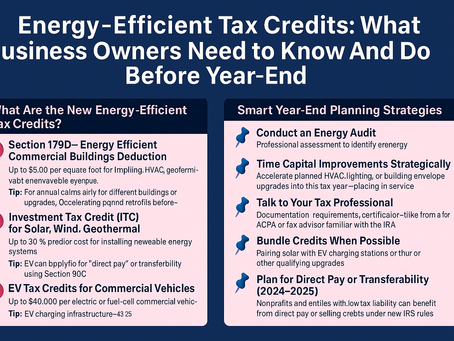

Energy-Efficient Tax Credits: What You Need to Know (And Do) Before Year-End

As energy costs rise and environmental responsibility becomes more important, business owners have a unique opportunity to benefit from federal energy-efficient tax credits—while reducing operational expenses and contributing to a greener future.

Cherie Sayban

Aug 12, 20254 min read

Navigating 2025: Key Accounting Trends and Insights for Small Business Owners

As we step into 2025, the accounting landscape continues to evolve, shaped by technological advancements, regulatory changes, and the...

Cherie Sayban

Jan 23, 20253 min read

A Comprehensive Guide to 1099s for Small Business Owners: 2025 Tax Preparation

In this guide, I’ll cover the essentials: different types of 1099 forms, key deadlines, and practical tips for ensuring you're prepared.

Cherie Sayban

Jan 7, 20253 min read

Mastering QuickBooks: A Guide to Learning and Training

Whether you're a small business owner, an aspiring accountant, or a seasoned professional looking to enhance your skills, learning QuickBook

Cherie Sayban

Jul 8, 20244 min read

bottom of page