top of page

Financial Resources for Businesses

How to Structure Your Business for Maximum Tax Savings: LLC, S-Corp, or C-Corp

Choosing the right legal structure for your business is one of the most important decisions you’ll make. Not only does it impact legal liability and management flexibility, it can dramatically influence how much tax you pay . With the right structure, you can unlock meaningful tax savings, retain more profits, and better plan for growth — but the wrong choice can cost you thousands. This guide breaks down the key differences between the most common structures — LLC, S-Corpor

Cherie Sayban

1 day ago5 min read

Accrual vs. Cash Accounting: What You Need to Know to Choose the Right Method

Choosing the right accounting method is one of the most important decisions small- and mid-size business owners make—one that impacts financial clarity, tax planning, and day-to-day management. Two primary methods exist: cash accounting and accrual accounting. Each offers distinct advantages, and understanding how they work will help you select the approach that best supports your operations and long-term goals.

Cherie Sayban

Dec 8, 20253 min read

Improve Your Cash Flow Now: Smart Steps Every Small Business Can Tak

Cash flow is the lifeblood of any small business. Even if you’re profitable on paper, running out of cash means you can’t pay bills, cover payroll, or seize growth opportunities.

Cherie Sayban

Nov 11, 20253 min read

Modernizing Federal Payments: What Small Businesses Need to Know

On March 25, 2025, President Trump signed Executive Order 14247: “Modernizing Payments To and From America’s Bank Account”, setting in motion a major change in how the federal government disburses and collects funds.

Cherie Sayban

Oct 1, 20257 min read

How the “No Tax on Tips” Provision Works – And What You Need to Know

The “No Tax on Tips” proposal aims to exclude tips from federal income tax. This means: Tipped workers would no longer owe federal income tax on their reported tips and...

Cherie Sayban

Sep 12, 20253 min read

New Law at a Glance: Key Changes to Energy-Efficient Tax Credits

In July 2025, the One Big Beautiful Bill Act (OBBBA) was signed into law. It accelerates the expiration of several energy-related tax credits previously extended under the Inflation Reduction Act (IRA). Here's what individuals need to know

Cherie Sayban

Sep 2, 20254 min read

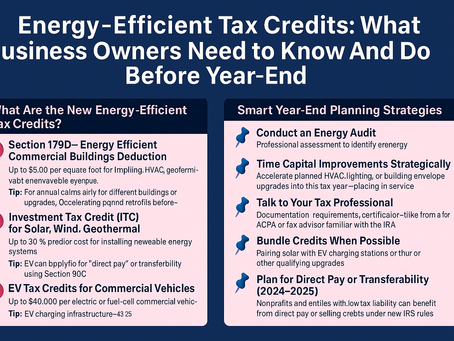

Energy-Efficient Tax Credits: What You Need to Know (And Do) Before Year-End

As energy costs rise and environmental responsibility becomes more important, business owners have a unique opportunity to benefit from federal energy-efficient tax credits—while reducing operational expenses and contributing to a greener future.

Cherie Sayban

Aug 12, 20254 min read

How the “Big Beautiful Bill” Impacts Your Taxes: An Interview with CPA Cherie Sayban

The recently passed “Big Beautiful Bill” is making waves across the U.S., promising to overhaul parts of the tax code and introduce new provisions that will affect individuals, small business owners, and high-income earners alike.

Cherie Sayban

Jul 8, 20255 min read

Optimizing Financial Reporting Through Effective Monthly and Quarterly Closing Procedures

Optimizing these closing procedures not only ensures data integrity but also enhances the finance team’s ability to deliver actionable insights promptly.

Cherie Sayban

Jul 3, 20253 min read

Maximizing the Value of Non-Cash Donations: A Smarter Way to Give and Save

Track your donations year-round and import them into TurboTax at tax time to get every dollar you deserve.

Cherie Sayban

Jun 3, 20253 min read

Understanding the Inflation Reduction Act: What CPAs Need to Know

As a seasoned CPA with over 25 years in the field, I’ve seen many legislative changes impact our profession and our clients. But few have been as sweeping or as opportunity-rich as the Inflation Reduction Act (IRA) of 2022.

Cherie Sayban

May 19, 20254 min read

Maximizing Retirement Contributions in 2025: New Limits and Opportunities for Small Business Owners

The IRS has rolled out new retirement contribution limits for 2025, offering fresh opportunities to boost your savings and reduce your tax burden.

Cherie Sayban

Apr 22, 20254 min read

IRS Audit Trends for 2025: Red Flags to Avoid

Understanding what triggers IRS scrutiny is key—especially for small business owners, self-employed individuals, and high-income earners.

Cherie Sayban

Apr 7, 20254 min read

Common Scams Targeting Small Business Owners & How to Protect Yourself

We will discuss some of the most common and recent scams, including deceptive text messages impersonating toll services and USPS and how to

Cherie Sayban

Mar 24, 20253 min read

Managing Cash Flow During Economic Uncertainty: A CPA’s Guide for Businesses

In times of economic uncertainty, businesses of all sizes face significant challenges in managing cash flow.

Cherie Sayban

Mar 11, 20253 min read

Top Five Key Focus Areas for Small Business Owners with the New Administration

The business landscape in 2025 is evolving rapidly, and small businesses must stay informed to remain competitive and compliant.

Cherie Sayban

Feb 24, 20254 min read

How to Maximize Your Tax Refund This Year

Increase your Tax Refund & Follow these Proven CPA-Backed Tips

Cherie Sayban

Feb 13, 20255 min read

Navigating 2025: Key Accounting Trends and Insights for Small Business Owners

As we step into 2025, the accounting landscape continues to evolve, shaped by technological advancements, regulatory changes, and the...

Cherie Sayban

Jan 23, 20253 min read

A Comprehensive Guide to 1099s for Small Business Owners: 2025 Tax Preparation

In this guide, I’ll cover the essentials: different types of 1099 forms, key deadlines, and practical tips for ensuring you're prepared.

Cherie Sayban

Jan 7, 20253 min read

Preparing Your Business for Success in 2025: A CPA’s Guide to Year-End Organization

Here’s a step-by-step guide from an experienced CPA to help you get organized and start the year off right.

Cherie Sayban

Dec 11, 20243 min read

bottom of page