top of page

Financial Resources for Businesses

Accrual vs. Cash Accounting: What You Need to Know to Choose the Right Method

Choosing the right accounting method is one of the most important decisions small- and mid-size business owners make—one that impacts financial clarity, tax planning, and day-to-day management. Two primary methods exist: cash accounting and accrual accounting. Each offers distinct advantages, and understanding how they work will help you select the approach that best supports your operations and long-term goals.

Cherie Sayban

Dec 8, 20253 min read

Improve Your Cash Flow Now: Smart Steps Every Small Business Can Tak

Cash flow is the lifeblood of any small business. Even if you’re profitable on paper, running out of cash means you can’t pay bills, cover payroll, or seize growth opportunities.

Cherie Sayban

Nov 11, 20253 min read

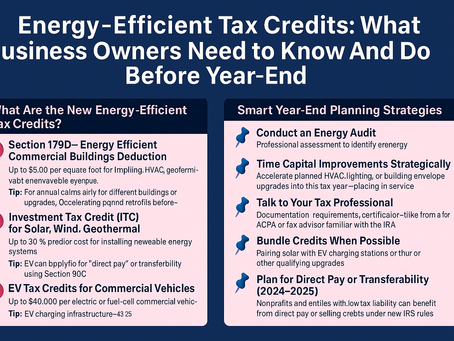

Energy-Efficient Tax Credits: What You Need to Know (And Do) Before Year-End

As energy costs rise and environmental responsibility becomes more important, business owners have a unique opportunity to benefit from federal energy-efficient tax credits—while reducing operational expenses and contributing to a greener future.

Cherie Sayban

Aug 12, 20254 min read

Optimizing Financial Reporting Through Effective Monthly and Quarterly Closing Procedures

Optimizing these closing procedures not only ensures data integrity but also enhances the finance team’s ability to deliver actionable insights promptly.

Cherie Sayban

Jul 3, 20253 min read

Maximizing Retirement Contributions in 2025: New Limits and Opportunities for Small Business Owners

The IRS has rolled out new retirement contribution limits for 2025, offering fresh opportunities to boost your savings and reduce your tax burden.

Cherie Sayban

Apr 22, 20254 min read

Common Scams Targeting Small Business Owners & How to Protect Yourself

We will discuss some of the most common and recent scams, including deceptive text messages impersonating toll services and USPS and how to

Cherie Sayban

Mar 24, 20253 min read

Top Five Key Focus Areas for Small Business Owners with the New Administration

The business landscape in 2025 is evolving rapidly, and small businesses must stay informed to remain competitive and compliant.

Cherie Sayban

Feb 24, 20254 min read

How to Maximize Your Tax Refund This Year

Increase your Tax Refund & Follow these Proven CPA-Backed Tips

Cherie Sayban

Feb 13, 20255 min read

Navigating 2025: Key Accounting Trends and Insights for Small Business Owners

As we step into 2025, the accounting landscape continues to evolve, shaped by technological advancements, regulatory changes, and the...

Cherie Sayban

Jan 23, 20253 min read

A Comprehensive Guide to 1099s for Small Business Owners: 2025 Tax Preparation

In this guide, I’ll cover the essentials: different types of 1099 forms, key deadlines, and practical tips for ensuring you're prepared.

Cherie Sayban

Jan 7, 20253 min read

Preparing Your Business for Success in 2025: A CPA’s Guide to Year-End Organization

Here’s a step-by-step guide from an experienced CPA to help you get organized and start the year off right.

Cherie Sayban

Dec 11, 20243 min read

How-to File the Beneficial Ownership Information Report (BOIR): A Comprehensive Guide for Small Business Owners

Check out this comprehensive, how-to guide on BOIR filing. While I strongly recommend you advise with your own personal attorney about BOIR,

Cherie Sayban

Nov 19, 20244 min read

The Top Apps to Track Expenditures & Master Your Finances

Gone are the days of manual ledger entries & complex spreadsheets; now, there's an app for everything, including tracking your expenditures.

Cherie Sayban

May 7, 20243 min read

Maximizing Your Tax Benefits: Understanding Different Types of Tax Deductions

Tax season can be daunting, but understanding the various types of tax deductions available can make the process smoother and even save...

Cherie Sayban

Apr 8, 20245 min read

Unlocking Financial Clarity: 10 Essential Questions to Ask Your Accountant

From tax strategies to financial planning, here are ten key inquiries to ensure you're getting the most out of your accounting partnership.

Cherie Sayban

Mar 18, 20243 min read

bottom of page