top of page

Financial Resources for Businesses

Modernizing Federal Payments: What Small Businesses Need to Know

On March 25, 2025, President Trump signed Executive Order 14247: “Modernizing Payments To and From America’s Bank Account”, setting in motion a major change in how the federal government disburses and collects funds.

Cherie Sayban

Oct 1, 20257 min read

New Law at a Glance: Key Changes to Energy-Efficient Tax Credits

In July 2025, the One Big Beautiful Bill Act (OBBBA) was signed into law. It accelerates the expiration of several energy-related tax credits previously extended under the Inflation Reduction Act (IRA). Here's what individuals need to know

Cherie Sayban

Sep 2, 20254 min read

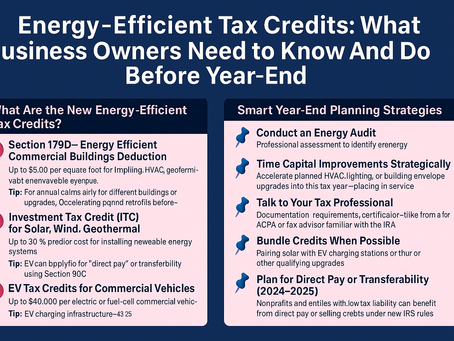

Energy-Efficient Tax Credits: What You Need to Know (And Do) Before Year-End

As energy costs rise and environmental responsibility becomes more important, business owners have a unique opportunity to benefit from federal energy-efficient tax credits—while reducing operational expenses and contributing to a greener future.

Cherie Sayban

Aug 12, 20254 min read

How the “Big Beautiful Bill” Impacts Your Taxes: An Interview with CPA Cherie Sayban

The recently passed “Big Beautiful Bill” is making waves across the U.S., promising to overhaul parts of the tax code and introduce new provisions that will affect individuals, small business owners, and high-income earners alike.

Cherie Sayban

Jul 8, 20255 min read

Optimizing Financial Reporting Through Effective Monthly and Quarterly Closing Procedures

Optimizing these closing procedures not only ensures data integrity but also enhances the finance team’s ability to deliver actionable insights promptly.

Cherie Sayban

Jul 3, 20253 min read

Maximizing the Value of Non-Cash Donations: A Smarter Way to Give and Save

Track your donations year-round and import them into TurboTax at tax time to get every dollar you deserve.

Cherie Sayban

Jun 3, 20253 min read

Understanding the Inflation Reduction Act: What CPAs Need to Know

As a seasoned CPA with over 25 years in the field, I’ve seen many legislative changes impact our profession and our clients. But few have been as sweeping or as opportunity-rich as the Inflation Reduction Act (IRA) of 2022.

Cherie Sayban

May 19, 20254 min read

IRS Audit Trends for 2025: Red Flags to Avoid

Understanding what triggers IRS scrutiny is key—especially for small business owners, self-employed individuals, and high-income earners.

Cherie Sayban

Apr 7, 20254 min read

bottom of page